We believe in the transformative power of Crypto/Web3

We believe that Crypto/Web3 will revolutionise many industries, create a stronger stakeholder economy, and redefine the way we create, share, and distribute value.

Our mission is to demystify this still broadly misunderstood but truly game-changing technology and asset class in an unbiased, research-driven, and fact-based manner.

Crypto and Web3 for us is “liquid venture capital.” It combines the visionary, high-risk ethos of traditional venture capital with the precision and agility of data-driven, actively managed liquid portfolios. Thriving in this hybrid asset class demands innovative investment strategies.

That’s why our founding team brings together deep experience in both venture capital and quantitative finance —merging visionary thinking with rigorous execution.

On-chain data offers a level of transparency and behavioral insight into the crypto market that is unparalleled in traditional finance. At Fountainhead Digital, we apply these insights to develop quantitative investment strategies. Our models are powered by indicators and market intelligence from Glassnode—the global leader in on-chain analytics.

“ Our relationship with Fountainhead goes beyond a typical client-vendor dynamic. Their understanding of on-chain analytics has not only impressed our team, but also contributed meaningfully to our product roadmap. We highly value their insights, and consider Fountainhead a forward-thinking voice in the digital asset investment space”

We design non-price-based quantitative investment strategies primarily built on on-chain data and derivative market signals. These strategies are engineered to reduce volatility and limit drawdowns, rather than to maximize short-term gains. They are implemented within the Web3 Digital Asset Innovations ETI and are also available to funds seeking to manage single-asset or multi-asset portfolios with a focus on improving risk-adjusted returns.

We offer a broad and unbiased view of the crypto market and act as industry advisor for financial institutions. Persistent misconceptions—often due to a lack of clarity—still hold many back. We help wealth managers navigate this complex space with confidence, enabling informed, merit-based decisions and preparing them for a new generation of investors increasingly seeking crypto exposure.

On-chain data offers a level of transparency and behavioral insight into the crypto market that is unparalleled in traditional finance. At Fountainhead Digital, we apply these insights to develop quantitative investment strategies. Our models are powered by indicators and market intelligence from Glassnode—the global leader in on-chain analytics.

“ Our relationship with Fountainhead goes beyond a typical client-vendor dynamic. Their understanding of on-chain analytics has not only impressed our team, but also contributed meaningfully to our product roadmap. We highly value their insights, and consider Fountainhead a forward-thinking voice in the digital asset investment space”

We design non-price-based quantitative investment strategies primarily built on on-chain data and derivative market signals. These strategies are engineered to reduce volatility and limit drawdowns, rather than to maximize short-term gains. They are implemented within the Web3 Digital Asset Innovations ETI and are also available to funds seeking to manage single-asset or multi-asset portfolios with a focus on improving risk-adjusted returns.

Our fundamental research, combined with proprietary quantitative strategies, is applied in the Web3 Digital Asset Innovations ETI – a listed certificate.

We offer a broad and unbiased view of the crypto market and act as industry advisor for financial institutions. Persistent misconceptions—often due to a lack of clarity—still hold many back. We help wealth managers navigate this complex space with confidence, enabling informed, merit-based decisions and preparing them for a new generation of investors increasingly seeking crypto exposure.

Crypto is often fragmented by ideological camps and emotional bias. We take a rational, data-driven view—treating crypto as a fast-evolving tech sector, not a belief system. Objectivity guides every decision.

We operate with professional rigor—in analysis, structure, and communication. Our goal is to elevate digital assets to the same institutional standard as other established asset classes.

“We are students of crypto”—a sentiment we share with BlackRock. This market is still full of open questions, and the exact future landscape remains uncertain. But that’s exactly what drives us. In crypto, nothing is set in stone—the market learns by doing. We aim to contribute to those learnings and help shape the future of this evolving ecosystem.

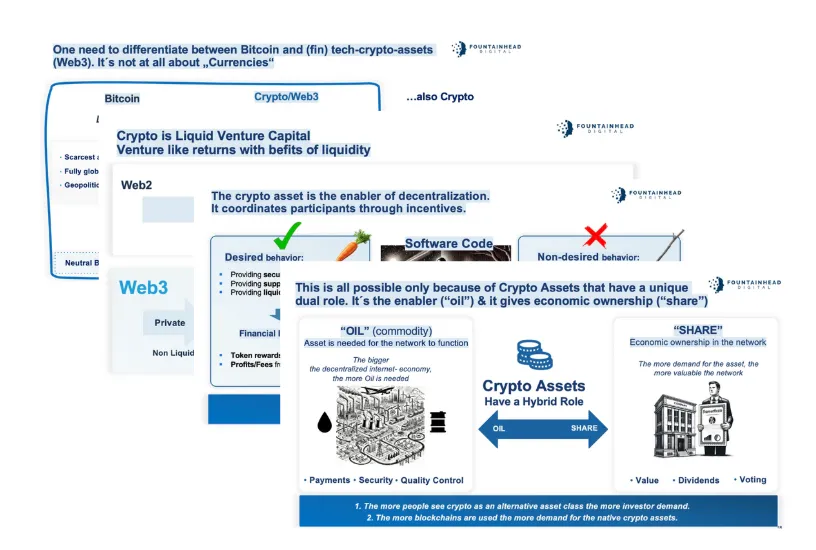

After dozens of conversations with private banks and wealth managers, we realized that a few key ideas helped make the crypto and Web3 world much clearer.

Why do tokens matter? What’s the real difference between Bitcoin and everything else? And why do we believe crypto assets are not that different from stocks?

In this section, we break it down — clear, structured, and straight to the point. Topics include:

Wealth managers and traditional asset managers need new tools, strategies, and skills to stay competitive with the next generation of investors. At Fountainhead Digital, we help you integrate digital assets with confidence — through research, advisory, and investment products built for professionals.

Download the full presentation about the “Great Wealth Transfer and its impact on Wealth Managers”. The presentation includes insights from leading industry studies behind the trends and statements mentioned above.

Your shortcut to this month’s most important crypto news & developments – plus our take on what really matters.