The still-common narrative that “blockchain is good, crypto is bad” is fundamentally flawed. Public (decentralized) blockchains cannot function without crypto assets. The two are inseparable parts of a single system.

That’s why we view Crypto – not just “blockchain” – as the technology. Crypto encompasses both tokens (crypto assets) and blockchains.

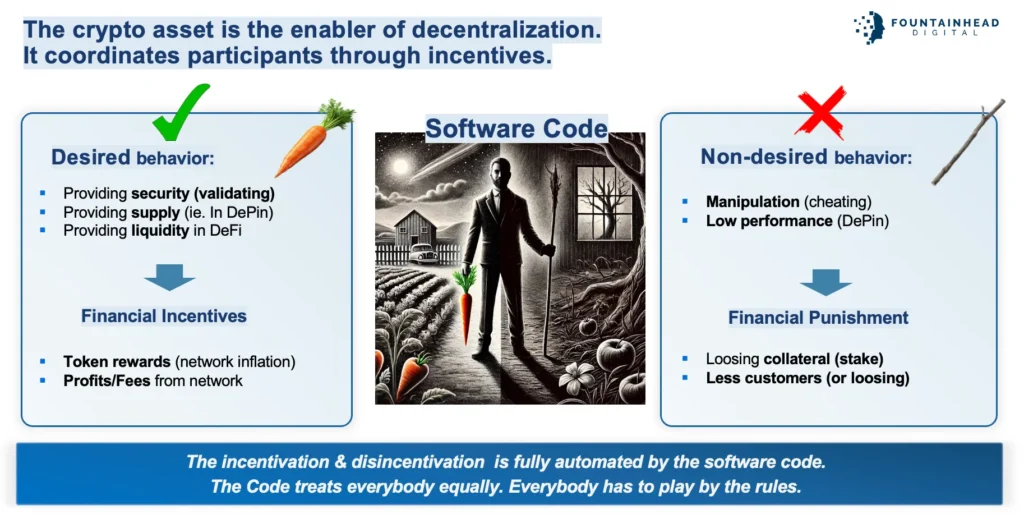

Crypto assets are the incentive layer and economic engine of decentralized systems. They align behavior by rewarding rule-followers and punishing bad actors. These rules are enforced by code—not people—creating systems that are transparent, fair, and built on trust in technology rather than institutions.

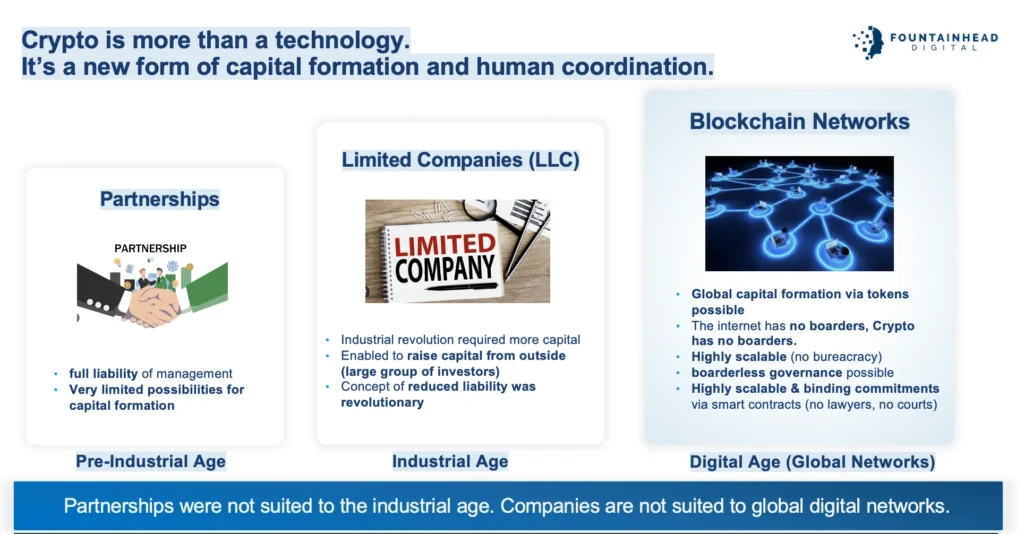

During the industrial revolution, partnerships couldn’t support large-scale capital formation. The limited company solved this by separating ownership from management, unlocking broader investor participation.

Today, our globally connected digital world faces similar structural limits. Traditional legal entities aren’t built for borderless coordination. Blockchain networks – powered by tokens – provide a more scalable, agile alternative and enable a alignment of global stakeholders without intermediaries, bureaucracy, or geographic barriers.

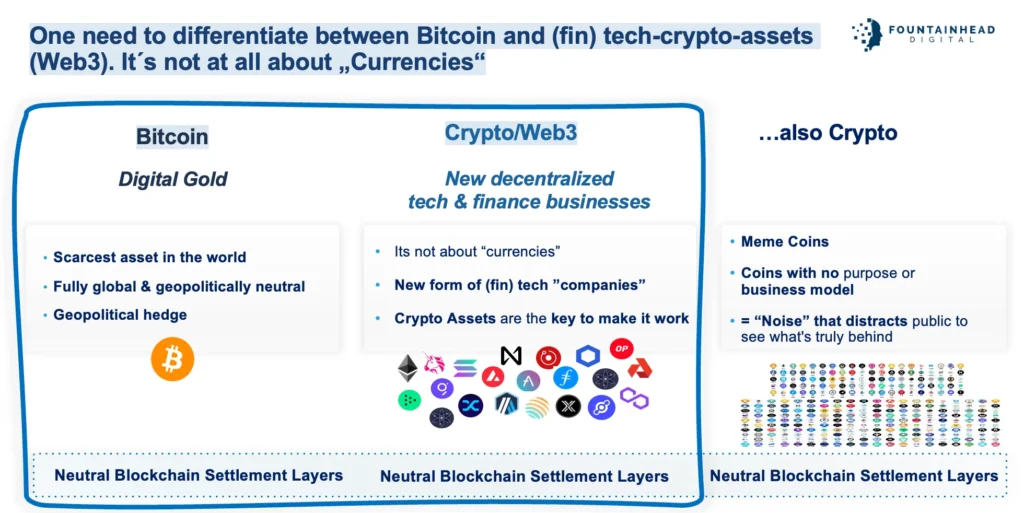

Bitcoin stands apart – perceived as digital gold by a growing mass of people , but with numerous advantages over the analog Gold: transferable, scarce by design, and divisible. Today, it primarily serves as a store of value.

In contrast, Web3 assets (often called “Altcoins”) enable new decentralized tech business models that address a wide range of challenges across industries. Such tech businesses are built on more flexible blockchains (so called “smart contract blockchains”) that can support a much wider range of innovation and use cases.

For us, it’s not either-or: Bitcoin stands for simplicity and “stability”, while Web3 assets (”Tech Altcoins”) offer greater innovation and growth potential – albeit with greater risk. Web3 for us is a decentralized NASDAQ.

In a time when trust in traditional institutions and governments is steadily eroding, a decentralized store of value (Bitcoin) and decentralised business models with growing, sustainable revenue streams (Web3) are becoming increasingly attractive. Bitcoin and Web3 represent globally neutral infrastructure: There are no central authorities, no arbitrary interventions—and no tariffs or trade restrictions that can limit their use.

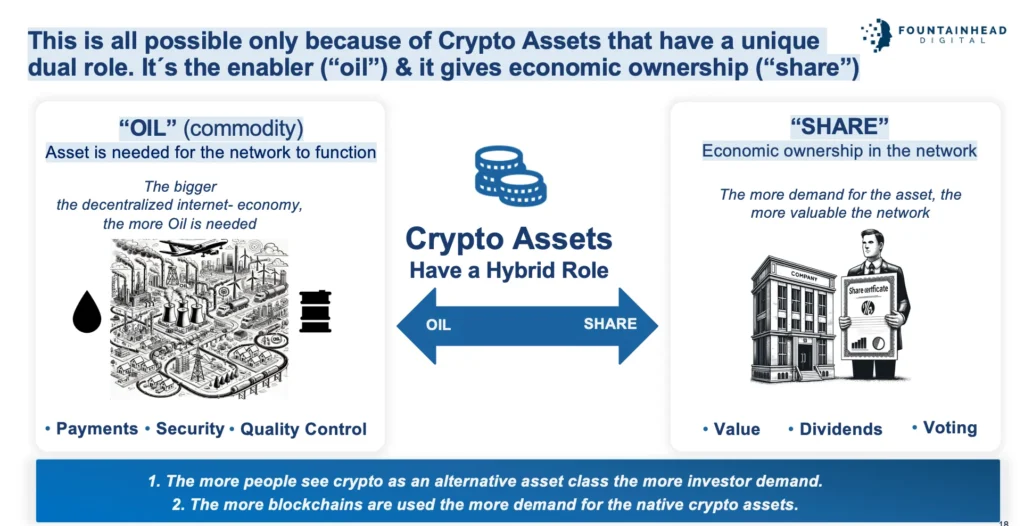

Crypto assets have a truly unique dual role. On one hand, they function similarly to equities—offering value appreciation, yield (cash flows) and governance rights. On the other hand, they are integral to the utility and functioning of decentralized products and services.

Unlike traditional assets, crypto tokens are not just investment vehicles—they are the operational fuel of decentralized ecosystems. Just as oil powers an industrial economy, crypto assets power Web3 applications. The more these services are adopted and used, the greater the demand for the underlying tokens—creating a direct link between utility and value.

Blockchain-based, decentralized business models unlock an entirely new dimension of data accessibility. On one hand, key business KPIs such as users, transactions, fees, and revenues become visible in real time, as most activity occurs directly on-chain. It’s like having a live P&L dashboard.

On the other hand, if investors buy or sell their crypto assets it leaves a transparent, immutable footprint. Every transaction reveals deep insights into investor behaviour:

Who is selling – large holders or retail? Are they new market entrants or long-term participants? Are they realising profits or capitulating at a loss? It can provide you an X-ray of real-time market sentiment and investor actions.

This emerging and powerful field is known as on-chain data analytics – and we are at the forefront of turning these unique data streams into strategic investment intelligence.

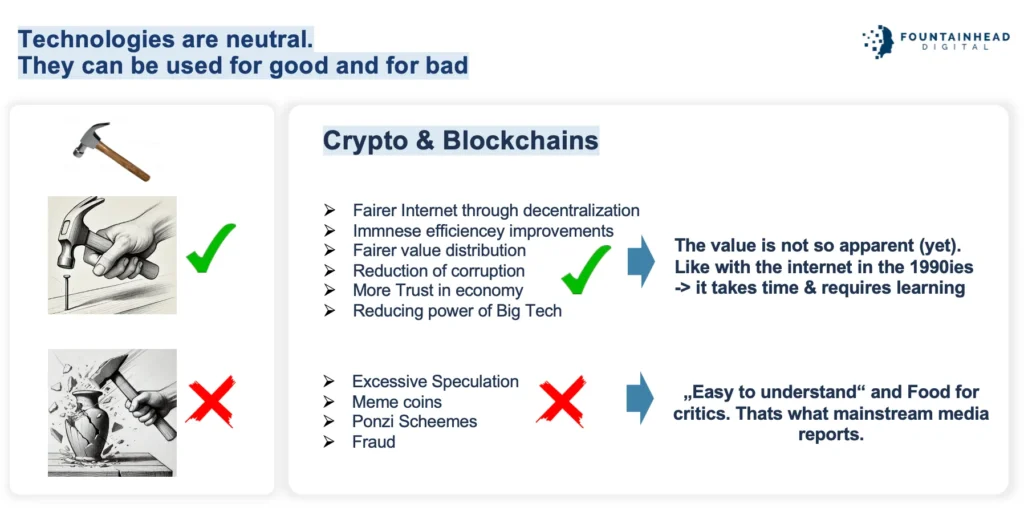

Blockchain, like any foundational technology, is neutral. It can be used for good or for bad. But dismissing Web3 or crypto because of isolated misuse or bad actors is like rejecting the internet because of phishing emails. These examples are the exception—not the rule.

Just like the internet changed how we share and consume information, crypto is changing how we share and transfer assets and value — and that shift might be even bigger.

The vast majority of progress in Crypto is being driven by serious, long-term innovators focused on real-world applications, efficiency, and financial inclusion. Forward-thinking investors and financial institutions that take the time to understand and engage proactively won’t just avoid reputational risks—they’ll help shape and benefit from one of the most significant technological transformations of our time.

Saying crypto is a scam because of a few bad actors is like dismissing public equity as illegitimate because of penny stocks or the Wirecard scandal.

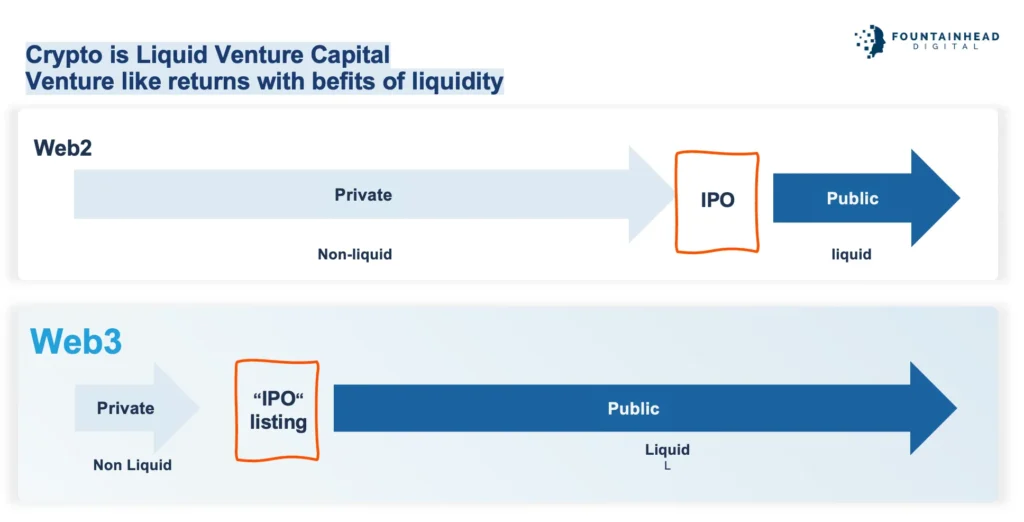

In traditional tech investing, startups stay private and illiquid for years—often only becoming accessible through increasingly rare IPOs. Web3 turns this model upside down: tokens are usually listed and tradable at a very early stage because they are central to the product’s functionality and business model.

But the liquidity is a blessing and a curse at the same time. It provides new opportunities—such as early access to innovation and flexible risk management—but also introduces challenges like high volatility and greater uncertainty.

Therefore we call Crypto: “Liquid Venture capital”. Venture capital like upside potential with the benefits of 24/7 liquidity. And we manage the liquidity with a systematic approach build on unique onchain data.

Crypto projects are, in essence, early-stage startups—with one critical difference: their tokens trade with 24/7 liquidity. This constant price discovery can be both a blessing and a curse. On the one hand, it offers flexibility and immediate market feedback; on the other, it amplifies volatility and emotional decision-making.

The open-source nature of Web3 accelerates innovation but also shifts the information landscape. Instead of structured quarterly updates, critical signals emerge through social media, community forums, and on-chain activity—creating a fast-moving, sometimes chaotic environment for investors.

At Fountainhead, we address this challenge with a systematic investment process powered by real-time, on-chain data. Our approach filters signal from noise, dynamically adjusts exposure, and ensures that liquidity is managed with discipline—not emotion.

In traditional equity markets, passive investing is often seen as superior to active management. But applying the same logic to crypto can be risky.

Crypto assets are more like early-stage startups. Each carries tech and market risk—within an industry that is still under construction. Built on open-source principles, crypto projects learn fast, copy fast, and move fast. Innovation happens in public and at high speed. What’s best today might already be outdated tomorrow.

Last but not least, the concept of tokens as vehicles for value accrual is entirely new. There’s no clear market consensus on how to value them. Value accrual design is still being debated and remains unsettled.

In short: The crypto market is still highly inefficient. That might seem intimidating – but it’s also why the upside is so high. Of course, so are the risks.

In such an environment, static portfolios become outdated quickly. Holding on to assets simply because they once showed promise ignores the dynamic nature of the market. The exception is Bitcoin. It has a singular purpose—store of value—and a level of maturity that allows for long-term positioning.

Everything else demands active oversight. While the potential upside is high, so too are the risks—and that requires a strategy designed to adapt.